Whether you have decided to stay with a long-term rental or still on the fence, we know you have that one question in the back of your mind. Do I want a loan from a private company or a loan from the bank? We know it can be confusing, so we are here to help you understand the difference.

What is considered a long-term loan?

A long-term loan is a loan with a typical period of three to thirty years. These long-term loans provide you with long-term solutions to finance rental properties in whatever area you choose. Long-term, or rental loans, allow for low fixed rates that provide investors monthly returns in the form of rental income. A helpful tip is to make sure your rental income is greater than your costs! This will allow you to either produce income or generate capital to buy additional rental properties.

What is the difference between the two?

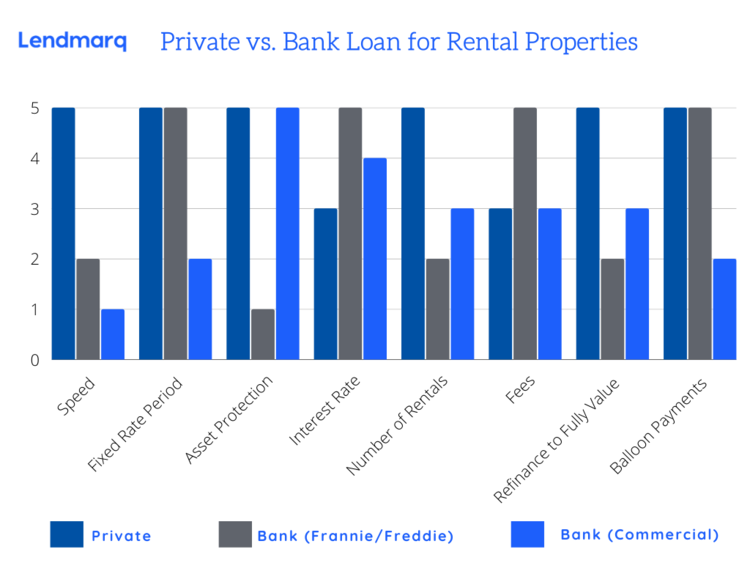

A private loan means that you are going through a private lending company, like Lendmarq. When working with us, we will assess the amount of money given solely based on the property value, your credit score, and the property’s ability to generate rent. A bank loan lends you the funds for your long-term rental based on the above factors, plus your personal income, your spouse’s income, an evaluation of every asset that you currently own, and their expenses. Furthermore, not all bank loans are created equal. Some bank loans end up going to Fannie Mae or Freddie Mac. While some are held at the bank as “commercial loans.” The terms provided for each of those types of bank loans are different and come with their own strengths and weaknesses.

Private Loans

In recent years private lending companies have opened up the option to obtain a loan for long-term rentals with fixed-rate financing options up to 30 years.

Benefits

- Financial History- When obtaining a private loan, financial history plays a role, but it is not as critical when applying for a bank loan. Lendmarq focuses on your credit score and loan payment history and skips global income analysis that takes time and might cause problems.

- Speed- When choosing Lendmarq we take away the constant back and forth between the bank and maintain effective communication. The average time to close a Lendmarq rental loan is 21 days, while banks average 45 days for their loans.

- Fixed-Rate Period- Lendmarq’s loans can be fixed for 30 years with no adjustments. This gives you the ability to forecast cash flows and peace of mind.

- Refinancing to Full Value (Seasoning) Criteria- Unlike going to the bank, we can be flexible with how much we can loan you. At Lendmarq, we can purchase and refinance up to 80% of the property value, and our requirements are much less than at a bank to get total value on refinances.

- Asset Protection- Lendmarq allows you to hold investment properties in an LLC or qualified business entity. This provides liability protection in case of an insurance or liability claim. Some bank loans require you to hold the property in your personal name, which gives renters that may file a lawsuit potential access to personal assets.

- Number of Rentals- Lendmarq does not have a limit on how many rental properties you can finance. Fannie/Freddie-backed loans have between 4 and 10 properties in total able to be financed. Bank commercial loans are limited by global income spread across all properties.

- Interest Rates- Lendmarq’s interest rates are generally more expensive than bank rates, but not always. However, rates are highly competitive, and the other advantages often offset the difference.

- Fees- Private bank loan fees may be higher than a Fannie/Freddie loan but are generally not higher than a bank commercial loan. Lendmarq’s fees are highly competitive when compared to banks, especially compared to other private lenders.

- Balloon Payments- There are no loan expiration dates or balloon payment periods with Lendmarq. Fannie/Freddie loans are also true, but bank commercial loans will often have a balloon payment forcing borrowers to refinance before they are ready, which can be costly.

Bank Loans

When obtaining a loan from the bank for a rental property, it’s the same lengthy process as obtaining any other loan. A bank loan is often used by those who not only have excellent credit but a high amount of global income. This is shown by providing every tax return and statement held by a borrower. Bank loans are divided into two categories: Fannie Mae / Freddie Mac sponsored and commercial loans.

- Fannie Mae / Freddie Mac – These are the least expensive rental loan options, but they come with several downsides. First, the loans must be held in a borrower’s personal name, removing any liability protection gained from owning investments in a qualified business entity. There are also limits on the number of properties allowed by Fannie/Freddie, limiting investor portfolio sizes over time. These loans are slower, but if liability protection and speed are not an issue, they might be the right choice for you.

- Commercial Loans – Private lenders like Lendmarq qualify these loans as “Business Purpose,” but a bank would categorize it as “Commercial.” These are loans that a bank makes that they do not sell to Fannie Mae or Freddie Mac. Community banks or regional banks offer these types of loans most often and typically will give rates above those of Fannie/Freddie-style loans. However, they only fix the rate for 5 or 10 years with balloon payments. Amortization periods are often 25 years, as opposed to 30. Fees charged are similar to those charged by Lendmarq, and rates are in line with Lendmarq loans, although they may be slightly lower depending on the strength of the borrower. Finally, banks have a strong desire to only offer these loans for borrowers who maintain their full banking relationships. This forces borrowers to switch bank accounts which adds to time and complexity.

Benefits

- Rates- Fannie / Freddie loans are the lowest rates available for rentals, but we have described the drawbacks.

- Fees- Fannie / Freddie loans most often do not include an origination fee, but all other closing costs are in line and similar. Bank commercial loan fees are in line with Lendmarq fees with not much difference.

- Other loan options- Lendmarq offers loans for investment properties, while banks have a wider range of options. These do get confusing and hard to manage, but home loans, auto loans, credit cards, etc., are also available from banks.

To learn more about the long-term rental loans and other loans we offer, contact us today.

Links: